June 2025 Austin Market Update | What Buyers & Sellers NEED to Know Now

If you’re thinking about moving to Austin or buying a home in the surrounding metro area, it’s crucial to understand the current market dynamics. The real estate landscape in Austin is evolving rapidly, with a staggering $277,000 price gap across different zip codes as of May 2025. This market disparity is reshaping how smart buyers approach their home search and investment strategy. In this comprehensive update, we’ll break down everything you need to know to navigate the Austin market effectively, save thousands, and avoid costly mistakes.

As experienced relocation experts living in Austin, Texas, we bring you the latest insights, mortgage updates, neighborhood rankings, and actionable tips to help you make informed decisions. Whether you’re moving next week or next year, this guide will arm you with the knowledge to find the right home in the right place at the right time.

Table of Contents

- Austin Real Estate Explained: 3 Tiers Every Buyer Must Know

- Mortgage Rate Trends in June 2025: What Buyers Need to Know

- Austin vs Suburbs: Where Are You Getting the Best Value?

- Top 3 Zip Codes to Buy a Home in the Austin Area

- Zip Codes to Avoid: Where Prices Are Dropping in 2025

- Austin Housing Inventory: County-by-County Breakdown

- Smart Buyer Tips for Moving to Austin, TX

- FAQs About June 2025 Austin Market Update

- Conclusion

Austin Real Estate Explained: 3 Tiers Every Buyer Must Know

The Austin real estate market isn’t just one monolithic entity; it’s actually three distinct markets or tiers, each with its own price points, lifestyle trade-offs, and investment potential. Understanding these tiers is essential to aligning your home buying goals with your budget and priorities.

Tier One: The Urban Premium – Austin and Travis County

This is the heart of Austin, where the median home price hovers around $525,000 as of May 2025. This tier commands a premium because it offers urban amenities, vibrant culture, and proximity to downtown jobs. It’s a fast-moving, highly competitive market where homes sell in about 45 days on average. Buyers here pay for convenience, speed, and liquidity. When the market shifts, these areas tend to recover the fastest thanks to strong demand and a large pool of buyers.

However, this premium comes with a price tag. You’re looking at not just a higher purchase price but also a bigger monthly mortgage and property taxes. For example, a home priced at $525,000 with 10% down on a conventional loan at a 6.72% interest rate results in a monthly mortgage payment of approximately $3,555 before taxes and insurance.

Tier Two: The Suburban Sweet Spot – Williamson and Hays Counties

Williamson and Hays counties offer a balanced alternative to urban Austin. Median home prices are lower here—around $425,000 in Williamson and just under $385,000 in Hays—yet these areas still boast strong schools, decent commutes, and growing communities. Homes in these suburbs tend to sell quickly, and the price per square foot is more attractive for buyers looking for real appreciation potential.

These suburbs are ideal for families and those who want more space without sacrificing access to city amenities. They also present excellent opportunities for potential rental properties due to steady demand and climbing interest.

Tier Three: Emerging Value – Bastrop and Caldwell Counties

For buyers who prioritize space and affordability over commute times, Bastrop and Caldwell counties are the places to watch. Median home prices here are the most affordable in the Austin metro area, hovering under $350,000. You can get a lot more house for your money—think 5-acre lots with pools for less than the cost of a small studio apartment in San Francisco.

The trade-off? Longer commutes and a slower sales pace. Homes here take about 76 days to sell, meaning buyers need to be patient and prepared for a longer timeline. But for remote workers or those looking for a quieter lifestyle, this is a jackpot of value.

Mortgage Rate Trends in June 2025: What Buyers Need to Know

Mortgage rates are a pivotal factor in your home buying budget, and as of June 2025, conventional 30-year fixed rates are steady at around 6.72%, while FHA loans are slightly lower at approximately 6.22%. These rates have stabilized for now, and the Austin market is starting to reflect this in its pricing.

One important tip: new construction homes often come with preferred lender rates that are significantly lower than the average rates you’ll find elsewhere. This can reduce your monthly mortgage payment substantially, making new builds an attractive option.

For example, on an FHA loan with just 3.5% down at 6.22%, your monthly mortgage payment on a median-priced Travis County home jumps to about $3,200 before taxes and insurance. However, using a builder’s preferred lender can lower this rate and your monthly costs.

Don’t forget to factor in property taxes and insurance. In Texas, property taxes average about $7,800 annually, and homeowners insurance can add another $4,000 a year. New construction homes often have lower insurance premiums due to modern building codes and materials. For instance, we personally pay less than $1,500 annually on insurance for our home purchased in 2022—a huge savings compared to older homes.

Austin vs Suburbs: Where Are You Getting the Best Value?

Is living in Austin worth the premium? The answer depends on what you value most: location, speed of sale, or price per square foot.

Homes in Austin (Travis County) sell on average in 45 days, while in Bastrop, it takes about 76 days. That’s an extra month where you might be paying two mortgages if you’re trying to time your move. The urban market’s fast pace and strong demand provide resale leverage, meaning you’re paying for liquidity — similar to how a mutual fund offers liquidity in investing.

However, not all urban neighborhoods are thriving. Some zip codes in Austin are sliding, with prices dropping and sellers having to negotiate more than usual. It’s important to avoid these areas if you want to protect your investment.

The Suburban Winners

Williamson and Hays counties, including cities like Round Rock, Cedar Park, Kyle, and Buda, are shining bright. These areas offer the best price per square foot and homes that sell quickly. Williamson County’s median price is about $425,000, and Hays County is just under $385,000.

These counties also boast strong schools and solid appreciation potential, making them great choices for families and investors. Hayes County, in particular, has the lowest inventory at just 3.8 months, indicating rising demand and competition.

The Emerging Value Zones

Bastrop and Caldwell counties are perfect for buyers who want space and affordability. With median prices under $350,000, these markets offer incredible value, especially for remote workers or those who don’t mind commuting. Imagine owning a 5-acre lot with a pool for less than the cost of a studio apartment in San Francisco — no HOA fees, no shared walls, just plenty of room to breathe.

Top 3 Zip Codes to Buy a Home in the Austin Area

We’ve developed a custom ranking system that scores zip codes based on home price, market speed, price appreciation, and seller negotiation behavior. This helps relocation buyers identify where they will win and where they might regret moving.

- Round Rock (78681): The top winner with a median price around $539,000. Homes sell in just 14 days, and sellers rarely budge on price, indicating a very strong market.

- Northwest Austin (78717): Offers great schools, 14% price appreciation, and solid price per square foot. A strong contender for buyers wanting urban perks without the highest premiums.

- Pflugerville (78660): Median home prices under $410,000 with fast sales and rising values. Bonus: it has an awesome skate park!

Zip Codes to Avoid: Where Prices Are Dropping in 2025

Not every neighborhood is a winner. Some areas are facing price declines and slower sales, which could hurt your investment.

- Westlake (78746): Median home price around $1.5 million, but prices are dropping and sellers are negotiating about 5% off the asking price. This is a buyer’s market here but may signal instability.

- Central Austin (78731): Beautiful area with homes selling extremely fast—in just 7 days. While this is great for sellers, it’s challenging for buyers relocating from far away who need more time to make decisions.

- Liberty Hill (78642): Prices down 15%, and homes are sitting on the market for about 65 days. This signals a red flag for market stability and could mean a longer wait or price drops ahead.

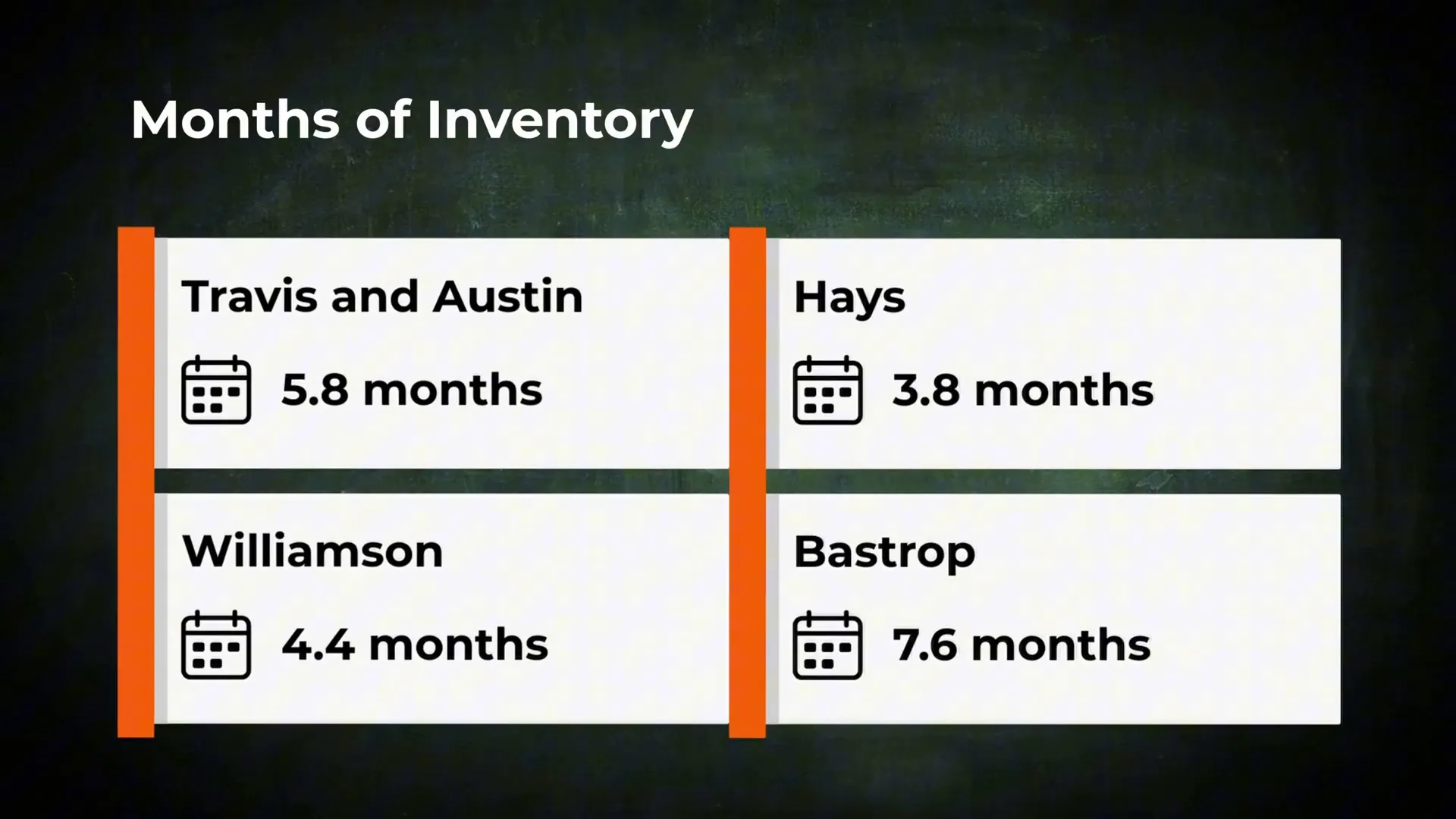

Austin Housing Inventory: County-by-County Breakdown

Inventory levels vary widely across the Austin metro area, impacting buyer power and market competitiveness:

- Austin and Travis County: About 5.8 months of inventory, a balanced but competitive market.

- Hays and Williamson Counties: Even tighter inventory at 3.8 and 4.4 months respectively, meaning strong demand and fast sales.

- Bastrop: The most inventory at 7.6 months, giving buyers more negotiation power and wiggle room.

Despite these variations, sellers across the region are still receiving between 93% and nearly 95% of their asking price. So, no matter where you look, the market isn’t a bargain bin — despite what some news headlines might suggest.

Smart Buyer Tips for Moving to Austin, TX

Whether you’re relocating from across the country or just moving within Texas, here are some essential tips to navigate the Austin real estate market successfully:

- Get Preapproved with a Texas Lender — Work with lenders who understand the local market nuances. We can recommend trusted lenders who offer competitive rates and smooth approvals.

- Explore Neighborhoods in Person — Don’t rely solely on online listings. Drive around and experience the neighborhoods to get a true feel for the area. We have several neighborhood videos that can help you start your exploration.

- Work with a Relocation Expert — Partner with us, your dedicated team of agents who possess firsthand experience in Austin’s market and relocation process. We’ve successfully guided hundreds of buyers and sellers through these waters.

- Consider Renting First — If you’re unsure, a short-term lease (like six months) can save you from making a long-term mistake. It gives you time to get acquainted with Austin before committing to a purchase.

This data is a snapshot of May 2025. The market is always evolving, so staying informed is key. Subscribe to monthly market updates to keep ahead of trends and make the smartest move possible!

VIEW HOMES FOR SALE IN AUSTIN TEXASFAQs About June 2025 Austin Market Update

Is Austin still a good place to buy a home in 2025?

Yes, Austin remains a strong market with solid demand, especially in urban and suburban areas. However, prices vary greatly by zip code, so it’s important to choose the right neighborhood based on your budget and lifestyle needs.

What are the current mortgage rates for buying in Austin?

As of June 2025, conventional 30-year fixed mortgage rates are around 6.72%, and FHA loans are about 6.22%. New construction homes often offer lower preferred lender rates, which can reduce your monthly payments.

What are the best suburbs near Austin to buy a home?

Williamson and Hays counties are the top suburban choices with great schools, affordable prices, and strong appreciation potential. Cities like Round Rock, Cedar Park, Kyle, and Buda are particularly attractive.

Should I buy new construction or an existing home?

New construction has several advantages including better mortgage rates via preferred lenders, lower insurance premiums, and modern amenities. However, existing homes may offer more immediate availability and established neighborhoods.

How long do homes typically stay on the market in Austin?

In urban Austin, homes sell quickly, averaging 45 days on market. Suburban areas like Williamson and Hays counties also see quick sales. More affordable areas like Bastrop and Caldwell may have longer market times, around 76 days.

Is it better to rent before buying in Austin?

If you’re relocating from far away or unsure about the market, renting short-term can be a smart choice. It gives you time to explore neighborhoods and understand the market before making a commitment.

Conclusion

The June 2025 Austin market update reveals a dynamic, tiered real estate landscape that demands careful consideration from buyers and sellers alike. With a $277,000 price gap across the metro area, understanding where to buy and when to act can save you thousands of dollars and months of frustration.

Whether you prioritize urban convenience, suburban schools, or rural space, Austin’s diverse market has something for everyone. Leveraging current mortgage trends, exploring neighborhoods in person, and working with relocation experts are your best strategies for success.

If you’re ready to make your move, start with a solid plan, get preapproved, and don’t hesitate to reach out for expert guidance. Austin’s housing market is competitive but full of opportunity — the key is knowing where to look and how to act. If you need to buy a home, contact us at 512-648-2828.

Living In Austin Texas

With years of experience in both residential and investment properties, they are dedicated to helping clients navigate Austin’s thriving market.

LIVING IN Austin TX

Specializing in relocation and real estate investment, they provide expert advice and guidance to help you find your dream home or investment property in the vibrant Austin market. Tune in for helpful tips, neighborhood tours, and insights on living in Austin.